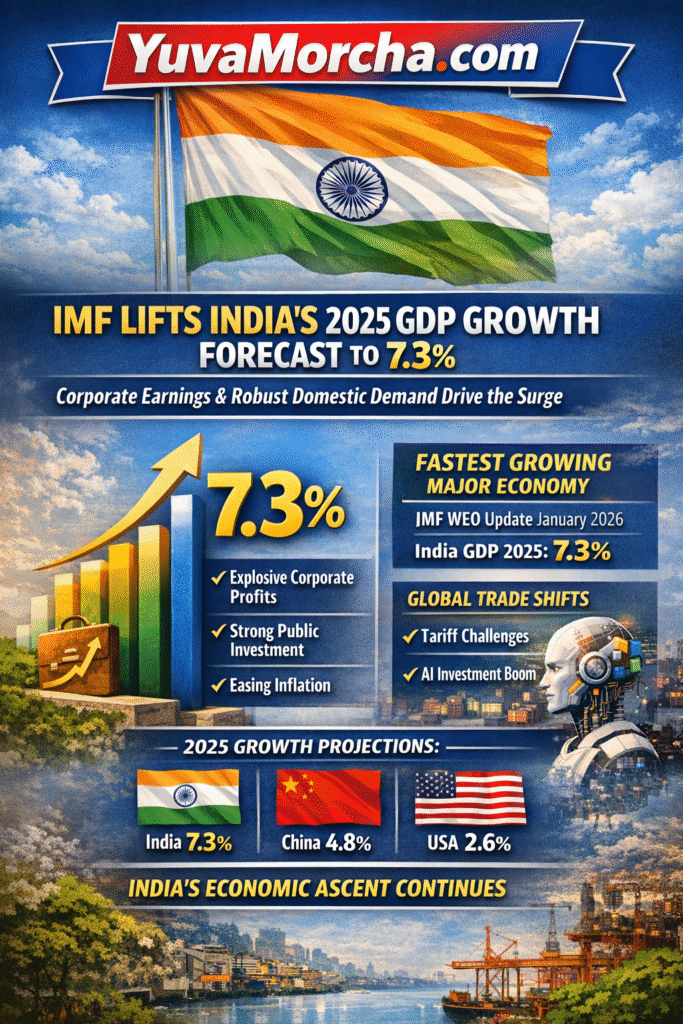

IMF Lifts India’s 2025 GDP Growth Forecast to 7.3%: Corporate Strength and Domestic Resilience Lead the Charge.

The IMF has upgraded India’s 2025 GDP growth forecast to 7.3%, citing a powerful surge in corporate earnings and resilient domestic demand. Discover why India remains the world’s fastest-growing major economy despite global trade shifts and tariff shocks.

The International Monetary Fund (IMF) has delivered a significant vote of confidence in the Indian economy. In its January 2026 World Economic Outlook (WEO) update, the global lender raised India’s GDP growth projection for 2025 to 7.3%, marking a sharp 0.7 percentage point increase from its previous estimates.

This upgrade reaffirms India’s status as the fastest-growing major economy globally, significantly outpacing other G20 nations and emerging market peers.

Key Drivers Behind the Upward Revision

The IMF’s decision to boost India’s outlook is not a mere statistical adjustment; it is backed by concrete “green shoots” appearing across the economic landscape.

1. Explosive Corporate Earnings

A primary catalyst for the revision is the better-than-expected corporate performance in the latter half of 2025. Stronger-than-anticipated earnings in the third and fourth quarters have restored investor confidence, triggering renewed capital inflows and stabilizing the stock markets after a period of volatility.

2. Robust Domestic Demand and Public Capex

While many global economies are grappling with slowing consumption, India’s domestic demand remains resilient. This is further bolstered by:

- Sustained Government Spending: Continued focus on infrastructure and public capital expenditure.

- Rural Recovery: A notable improvement in real household earnings in rural areas.

- Tax Reforms: Efficiency gains from streamlined tax structures driving higher GST collections.

3. Easing Inflationary Pressures

The IMF projects that India’s inflation will return to target levels (around 4%) after a sharp decline in 2025. This “Goldilocks” scenario—high growth coupled with low inflation—is largely driven by subdued food prices and prudent monetary policy by the RBI.

Global Economy Shakes Off Tariff Shocks

The upgrade for India comes at a time when the global economy is proving to be more resilient than many feared. Despite significant US-led tariff shocks and trade uncertainties at the start of 2026, the IMF has raised the global growth forecast for 2026 to 3.3%.

Why the world is still growing:

- The AI Investment Boom: A surge in technology-driven investment, particularly in Artificial Intelligence, is offsetting the drag from protectionist trade policies.

- Supply Chain Agility: Global firms have quickly adapted by diversifying supply chains and rerouting trade flows to mitigate the impact of tariffs.

- Tech-Skilled Workforce: India’s position as a global hub for high-skilled services and its massive base of Global Capability Centers (GCCs) have made it a vital player in this tech-led resilience.

Comparison: India vs. The World (2025-2026 Projections)

Region / Economy | 2025 Growth (Est.) | 2026 Growth (Proj.) |

|---|---|---|

India | 7.3% | 6.4% |

China | 4.8% | 4.5% |

United States | 2.6% | 2.4% |

Euro Area | 1.1% | 1.3% |

World Average | 3.3% | 3.3% |

Note: While India’s growth is expected to moderate to 6.4% in 2026 as temporary cyclical factors wane, it still remains the global leader in growth velocity.

The Bottom Line

The IMF’s upward revision to 7.3% is a clear indicator that India has successfully navigated recent global headwinds. With strengthening profitability trends, falling unemployment (reaching a low of 4.7% in late 2025), and a digital infrastructure that continues to scale, India is not just surviving global trade shifts, it is leading them.

As the world transitions further into an AI-driven economic era, India’s “tripod” of growth, stability, and confidence positions it as the most critical engine of global expansion for the foreseeable future.

Team: Credit Money Finance

More Featured Articles:

Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Unlock Growth: How to Secure ₹1 Cr – ₹15 Cr Unsecured Funding for Your Business

Unsecured CGTMSE MSME Loans from Leading Government Banks Exclusively for Self-Employed Individuals:

Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)