The 6 Stages of Personal Financial Collapse and How to Spot Them Early

1. The Gradual Fall, Not a Sudden Crash

Ernest Hemingway once said, “How did you go bankrupt? Two ways. Gradually, then suddenly.”

That line doesn’t just describe bankruptcy, it mirrors how most people lose control of their finances. Financial collapse doesn’t happen overnight. It begins quietly, disguised as comfort, convenience, or confidence.

It’s rarely one big mistake that ruins someone financially. It’s a series of small, seemingly harmless ones that slowly erode the foundation until it finally cracks.

2. Stage One: The Comfort of Ignorance

It begins with your first job and your first salary. That magical moment, “salary credited to your account.” You feel independent, alive, in control.

You buy things, celebrate, maybe take your friends out. You tell yourself, “I’ll start saving later.” But that “later” never comes. You don’t feel irresponsible, just young and deserving.

Ignorance feels safe at first, but it’s like a hairline crack in a wall, invisible until it spreads and weakens the entire structure.

3. Stage Two: The Illusion of Control

After a few months of spending, you start “investing”, maybe an SIP, a few stocks, or an insurance policy you barely understand.

You feel mature and financially aware, believing you’re managing your money well.

But this is motion without direction. You’re copying others, managing on autopilot, and mistaking activity for mastery. You feel in control, but only as long as life behaves predictably. Deep down, you don’t know what would happen if your income stopped tomorrow.

4. Stage Three: Lifestyle Inflation Trap

This is where the real trap begins, a socially accepted form of financial self-sabotage.

You get a raise, and your expenses rise with it. A better house, a nicer car, more takeout food. You justify it with, “I can afford it now.”

But each upgrade builds a lifestyle that constantly demands more. What once felt like luxury soon becomes normal, and once something becomes normal, it’s hard to go back.

Society cheers for you at this stage, “You’re doing well!”, but beneath the praise grows quiet anxiety:

the fear of losing your job, the pressure to maintain appearances.

You’re now running on a treadmill that won’t slow down.

5. Stage Four: The Debt Spiral

When income can’t keep up with lifestyle, debt steps in. You start buying on EMI, swiping credit cards, telling yourself you’ll “clear it next month.” But next month never arrives clean.

Debt feels empowering at first, a shortcut to the life you want. But soon it becomes a noose. You pay one card with another, your salary vanishes into obligations, and peace of mind disappears.

Warren Buffett once said, “Having large debt is like driving a car with a knife pointed at your heart. You drive carefully, but when accidents happen, they’re fatal.”

Debt is modern slavery, perfectly legal but quietly devastating.

6. Stage Five: The Storm of Denial

When the pressure becomes unbearable, denial begins. You stop checking your bank app. You ignore EMI reminders. You tell yourself, “Everyone has loans. It’s fine.”

You believe the next bonus or promotion will fix everything. But denial is like painting over rust, the surface looks fine, but the decay continues underneath.

Outwardly, you appear confident. Inwardly, you’re scared and exhausted, aware you’re losing control but afraid to face it.

7. Stage Six: The Collapse

And then..one day.. everything breaks.

A job loss, medical emergency, business failure, and suddenly, your income stops but the bills don’t. You do the math: “How long can I survive?” The answer hits hard, not long enough.

It feels unfair, but the collapse wasn’t sudden. It was the result of years of small neglects, excuses, and delayed decisions. The dam didn’t burst from one drop, but from thousands before it.

8. The Aftermath, Not Everyone Recovers

We love comeback stories, of people who lose everything, learn, and rebuild stronger.

But the truth? Most don’t recover. Many shrink their lives, live cautiously, one bill away from panic.

They lose their spark, their dreams, their self-trust. Some keep pretending, spending, and saying, “Someday I’ll fix it.” But someday never comes.

Money, once a symbol of freedom, becomes the chain that binds them, making them smaller, more fearful than they were meant to be.

9. Breaking the Cycle, Awareness is Everything

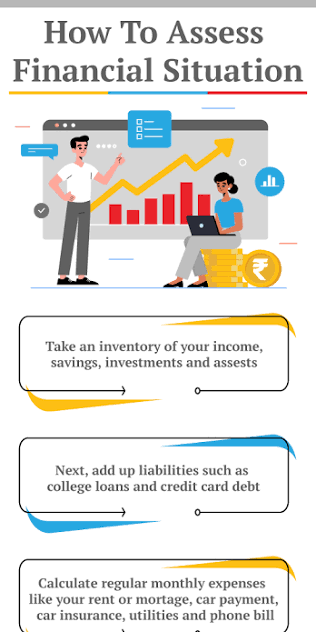

The only real defense is awareness. Take a few minutes today: open your bank app, review your expenses honestly, without guilt or excuses.

Ask yourself:

Where does my money actually go?

If my income stopped tomorrow, how long could I survive comfortably? If the answer makes you uneasy, that’s your cue.

Start small: Build an emergency fund, even one month’s worth. Cancel unused subscriptions. Sell things you don’t need. Cut one recurring expense, to remind yourself you’re in control.

10. Talk About Money

Silence keeps money problems alive. Conversations heal them. Talk to your spouse, parents, or friends, not to show off, but to understand yourself. You don’t have to fix everything today. Just begin paying attention. Awareness changes how you spend, save, and think.

11. The Real Goal of Personal Finance

Personal finance isn’t about money. It’s about mindfulness. It’s about knowing where your money goes, why, and whether it adds peace or noise to your life. The goal isn’t to get rich overnight, it’s to stop being blind to where you stand today. Because awareness, not income, determines financial freedom.

Team: Credit Money Finance