Unlock Growth Without Dilution: The Ultimate Guide to Revenue-Based Finance in India (2026)

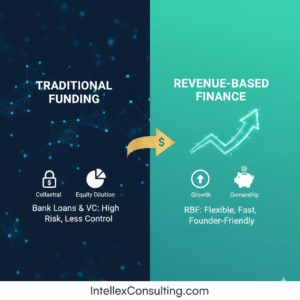

In the high-octane world of Indian startups and MSMEs, the hunger for capital is constant. Traditionally, founders were caught between two extremes: Venture Capital (VC), which demands a chunk of your soul (equity), and Bank Loans, which demand your house (collateral) and a fixed EMI regardless of your sales.

But what if you could raise capital based solely on the strength of your sales?

Welcome to the era of Revenue-Based Finance (RBF), the “third way” of funding that is currently sweeping the Indian ecosystem. Whether you are a D2C brand, a SaaS powerhouse, or an e-commerce giant, RBF offers the fuel you need without the strings you dread.

Also Read:

Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

What is Revenue-Based Finance (RBF)?

Revenue-Based Finance is a unique funding model where an investor provides upfront capital to a business in exchange for a fixed percentage of its future monthly revenues.

Unlike a loan, there are no fixed EMIs. Unlike equity, there is no dilution of ownership. You simply pay back as you earn. If your revenue drops in a particular month, your repayment drops too. If your revenue surges, you pay back faster and move on.

The Core Concept: How It Works

- The Advance: You receive a lump sum (e.g., ₹50 Lakhs).

- The Factor: The lender adds a flat “cost of capital” or fee (typically 6% to 12%). Total to be repaid: ₹55 Lakhs.

- The Share: You agree to share a small portion of your daily or monthly sales (e.g., 5%).

- The Finish: Once the ₹55 Lakhs is reached through these percentage shares, the contract ends. No more obligations.

Why RBF is Going Viral in India

As of 2026, the Indian market has matured. Founders are no longer willing to give up 20% of their company for a marketing budget. Here is why RBF is the preferred choice:

- Zero Equity Dilution: You keep 100% of your company. You don’t lose board seats or control.

- No Collateral Required: You don’t need to pledge personal assets or property.

- Speed of Light: While VCs take 6 months and Banks take 3 months, RBF platforms can fund you in 48 to 72 hours.

- Flexible Repayment: Your repayments “breathe” with your business. High sales = faster repayment; low sales = lower repayment.

Also Read:

Top 10 Angel Investment Networks in India (2026): The Ultimate Founder’s Guide to Fundraising.

Top Revenue-Based Lenders in India (2026 Landscape)

The RBF space in India is dominated by tech-first platforms that use AI to analyze your sales data and provide instant offers.

1. GetVantage

- Strategy: Focuses heavily on digital-first brands (D2C, E-commerce, SaaS).

- Investment Amount: ₹5 Lakhs to ₹5 Crores.

- Terms: No interest, just a flat fee. Repayment through a share of revenue.

- Ideal For: Marketing spend, inventory stocking, and seasonal spikes.

2. Recur Club

- Strategy: Specializes in companies with recurring revenue (SaaS, Subscriptions).

- Investment Amount: Up to ₹20 Crores+.

- Terms: They allow you to “trade” your future subscriptions for upfront cash today.

- Ideal For: Software companies looking to bridge the gap between monthly billing and annual needs.

3. Velocity

- Strategy: Deeply integrated with e-commerce platforms like Shopify, Amazon, and Ajio.

- Investment Amount: ₹10 Lakhs to ₹10 Crores.

- Terms: Data-driven underwriting with minimal documentation.

- Ideal For: D2C brands needing working capital for inventory.

4. Klub

- Strategy: Community-backed RBF that funds a wide range of brands across F&B, Fashion, and Personal Care.

- Investment Amount: Flexible, ranging from seed-stage to growth-stage.

Revenue-Based Finance vs. Other Funding Options

Feature | Revenue-Based Finance | Venture Capital | Bank Loan (Debt) |

|---|---|---|---|

Ownership | 100% Retained | Diluted (Shares given) | 100% Retained |

Repayment | % of Revenue | Exit / IPO | Fixed EMI |

Collateral | Not Required | Not Required | Required |

Speed | 2-7 Days | 3-6 Months | 1-3 Months |

Cost | Flat Fee (6-12%) | High (Opportunity cost) | Interest (10-18%) |

Also Read:

How to Qualify for RBF in India?

To secure RBF, your business needs to show a “digital footprint” of revenue. Most lenders look for:

- Monthly Revenue: Minimum ₹5 Lakhs to ₹10 Lakhs.

- Operating History: At least 6–12 months of active trading.

- Profitability: You don’t need to be net-profitable, but you should have healthy gross margins.

- Sector: Strong preference for D2C, B2B SaaS, EdTech, and Cloud Kitchens.

Expert Advisory for Your Funding Journey

Navigating the world of RBF, Venture Debt, and Private Equity can be overwhelming. This is where professional expertise makes the difference between a “good deal” and a “great partnership.”

Introducing Intellex Strategic Consulting Pvt Ltd

Intellex Strategic Consulting Pvt Ltd is a premier Financial Advisory Firm in India, dedicated to helping startups and established enterprises navigate the complex world of fund raising.

We don’t just point you to a lender; we build the bridge. Our specialized services include:

- RBF Strategy: Identifying if RBF is the right fit for your cash flow cycle.

- Business Plan & Pitch Decks: Crafting compelling narratives that resonate with modern digital lenders.

- Investor Matchmaking: Connecting you with the right RBF platforms, Venture Debt funds, or Angel Investors.

- Negotiation: Ensuring you get the lowest factor rates and the most flexible repayment terms.

Ready to Scale? Let’s Talk.

Whether you need working capital for your next big inventory push or growth capital to scale your SaaS product, Intellex is your strategic partner.

- Websites: IntellexConsulting.com | IntellexCFO.com

- WhatsApp: 98200-88394

- Email: intellex@intellexconsulting.com

Conclusion: The Future of Finance is Flexible

Revenue-Based Finance is not just a trend; it is a fundamental shift in how Indian businesses grow. By aligning the interests of the lender with the success of the business, RBF creates a win-win ecosystem. Don’t let equity dilution or rigid EMIs hold your vision back.

Team: IntellexCFO.com

More Featured Articles:

₹100 Crore for a Nobel Prize: Why Chandra Babu Naidu Is Thinking Decades Ahead of Indian Politics.

Invest in Sirius Jewels Lifestyles Franchise Opportunity

Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead.

Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)

Looks interesting and attractive.