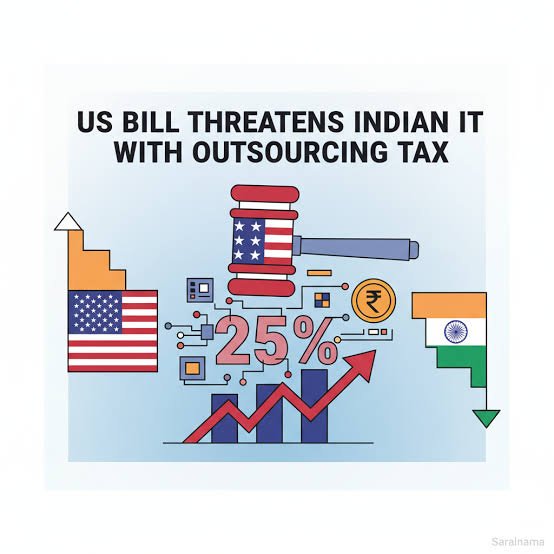

A 25% U.S. proposed outsourcing Tax could upend India’s $250 Billion IT services industry:

A 25% U.S. proposed outsourcing Tax could upend India’s $250 Billion IT services industry: A 25% U.S. outsourcing tax, proposed under the HIRE Act, could significantly impact India’s $250 billion IT services industry by increasing costs for American clients, reducing profits for Indian firms, potentially causing job losses in India, and reshaping global outsourcing dynamics […]