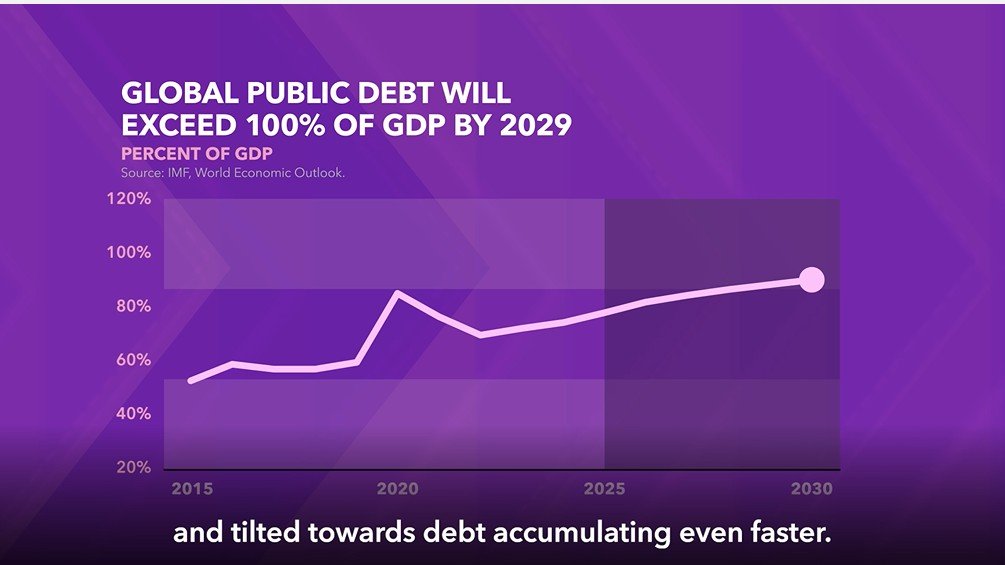

Global Government Debt Set to Break 100% of GDP by 2029, Warns IMF , a Red-Flag for the World Economy

Global Government Debt Set to Break 100% of GDP by 2029, Warns IMF , a Red-Flag for the World Economy In a stark warning issued by the International Monetary Fund (IMF), global public debt is on a trajectory to exceed 100 % of global Gross Domestic Product (GDP) by 2029 , a level not seen […]