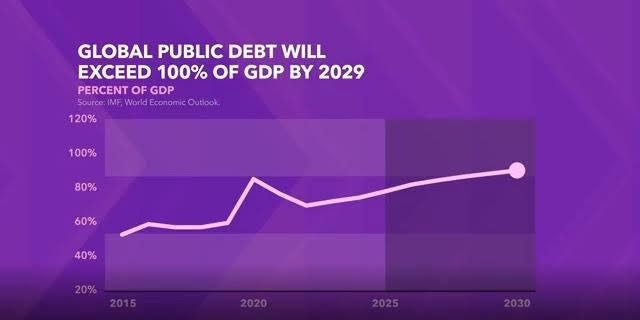

Global Government Debt Set to Break 100% of GDP by 2029, Warns IMF — A Red-Flag for the World Economy

In a stark warning issued by the International Monetary Fund (IMF), global public debt is on a trajectory to exceed 100 % of global Gross Domestic Product (GDP) by 2029 a level not seen since the aftermath of World War II. Under adverse conditions, this figure could even soar to around 123 % of global GDP.

This projection comes amid a confluence of rising borrowing costs, repeated fiscal deficits, ageing populations, defence and climate-related spending surges, and a muted appetite for tax increases.

What’s driving the debt surge?

Several interlinked forces are pushing public debt upward:

High interest rates: After the era of ultra-low rates, governments are now facing steeper financing costs, which raise the cost of servicing existing debt and make new borrowing more expensive.

Persistent fiscal deficits: Many countries continue to spend more than they collect in taxes, especially given increased demands for social spending, health care, infrastructure, defence and climate resilience.

Demographic and structural pressures: Ageing populations in advanced economies, heavier pension and health burdens, and slower productivity growth all reduce fiscal flexibility.

Geopolitical and environmental shocks: Defence spending, responses to climate disasters, and supply-chain stress from trade tensions are forcing additional borrowing.

Reluctance to raise taxes: The IMF notes strong political resistance to higher taxes, which limits governments’ ability to expand revenues.

Who is most vulnerable?

Among large economies, the U.S., Canada, France, Italy, Japan, the U.K. and China are already either above or projected to move above 100 % debt-to-GDP ratios.

Emerging and low-income countries face a harsher reality: even with lower nominal debt-to-GDP levels, they have weaker institutions, higher borrowing costs and limited ability to respond to shocks. The IMF flags 55 countries as being at high risk or already in debt distress.

Why does this matter?

Debt levels above 100 % of GDP mark a historic turning point; the IMF says that such a level would be the highest global average since 1948.

High sovereign debt can reduce fiscal space: less room to respond to economic downturns, natural disasters or financial crises.

As debt-servicing costs rise, governments may be forced to cut growth-enhancing spending (on infrastructure, education, health) or raise taxes — both of which may slow economic growth, creating a vicious cycle.

For countries with weak buffers, this may raise the risk of a “doom loop” in which debt burdens generate financial instability, triggering deeper fiscal stress.

What is the IMF recommending?

Building fiscal buffers now: Governments are urged to reduce deficits, strengthen tax collection, rationalise subsidies, and increase resilience ahead of shocks.

Re-prioritising spending toward growth-friendly areas (education, infrastructure, human capital) rather than just rising consumption or unproductive subsidies.

Improving governance and transparency: Stronger institutions, credible fiscal rules and better debt-management frameworks can reduce risk and borrowing costs.

Tailoring strategy by country: Advanced economies may have more options given deep capital markets, but emerging and low-income countries face tighter constraints and higher risk of debt distress.

What this means for India and other developing economies:

For India and similar emerging market economies:

While current debt-to-GDP levels are lower compared to some advanced economies, the global environment of higher interest rates, slower growth and tighter external financing means risks are real.

It reinforces the importance of maintaining strong fiscal discipline, increasing revenue mobilisation (via tax reforms, improved compliance), and using borrowed funds productively (in infrastructure, education, health) to lift long-term growth.

External shocks ,such as currency depreciation, capital outflows, or commodity price spikes could amplify debt burdens. Building buffers and limiting unproductive debt is vital.

Global investor sentiment may become less forgiving of high-debt or weak-governance economies. Sound fiscal fundamentals will help preserve access to capital markets.

In summary:

The IMF’s warning is a wake-up call: global public debt is trending toward historic levels, and the window to act is now.

Delaying reforms, continuing large deficits or borrowing without growth-enhancing returns increases the risk of fiscal stress, slower growth and lower resilience. Governments around the world — developed, emerging and low-income alike — must strengthen fiscal frameworks, redirect spending toward productive uses and build the space needed to respond to future shocks.

Team: Credit Money Finance

Post Views: 127