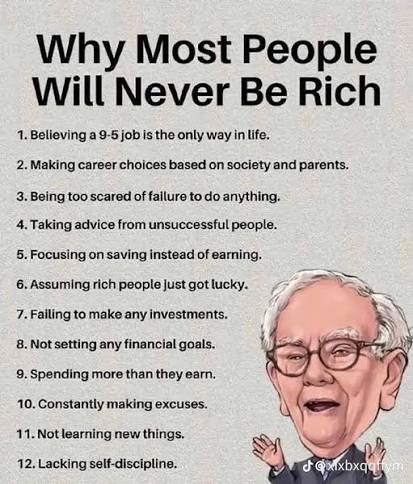

Why Most Investors Never Become Wealthy

Most investors never become wealthy primarily due to a lack of patience and discipline, emotional decision-making, insufficient capital, and a focus on short-term gains over long-term strategy.

Key reasons for this outcome include:

Emotional Decision-Making: Investors often fall victim to the fear-and-greed cycle, buying when the market is high (due to greed/FOMO) and selling when the market is low (due to panic). Successful investing, as Warren Buffett noted, is often about transferring money from the impatient to the patient.

Lack of Patience and Discipline: Building substantial wealth requires consistency and time, allowing compound interest to work its magic over decades. Many people quit too soon or use money set aside for investments for extraneous purposes, disrupting the compounding process.

Insufficient Investment Amount: Even a high rate of return on a small, inconsistent investment won’t yield significant wealth. Many people simply do not invest enough money for it to make them “rich”.

Absence of Clear Goals and Planning: Without specific financial goals (e.g., retirement, a home), investors lack a roadmap, leading to undirected and often poor investment choices. A well-defined investment plan helps in making rational decisions during market volatility.

Chasing Quick Riches (Speculation vs. Investing): Many people enter the market seeking quick, overnight profits, often through risky trading or following “tips” from unverified sources. This approach typically leads to losses, as opposed to the long-term, research-based strategies of successful investors.

Lack of Financial Education: A general lack of understanding of basic financial principles, risk management, and the impact of fees can lead to poor decisions, such as investing in high-fee products or failing to diversify adequately.

Spending More Than Earning (Inability to Delay Gratification): Wealthy people often reinvest their money into assets that generate more money, while the average person may spend their surplus on depreciating assets or an extravagant lifestyle to appear rich. Living below one’s means is a foundational step to building wealth.

Procrastination: Many people understand the need to invest but continually postpone starting, missing out on valuable years of market exposure and compound growth.

Wealth Building Principles

🔵 Most investors struggle because they lack disciplined, systematic processes for building wealth, instead relying on intuition or chasing trends.

🔵 Behavioral errors such as emotional decision making, holding onto losing assets, and disregarding rules for investing can erode long term returns.

Power of Simplicity & Rule based Systems

🔵 Consistent wealth creation comes from following simple, rule-based strategies rather than complex analysis or predictions.

🔵 Mechanical approaches like evaluating assets based on performance and setting automatic rules for buying or selling help minimize mistakes.

🔵 Adherence to fixed review schedules and pre defined rules is essential, rather than letting news headlines or market noise disrupt decisions.

Avoiding Investment Traps

🔵 Common pitfalls include reacting impulsively to market fluctuations and holding onto underperforming assets due to fear of loss or regret.

🔵 Portfolio rebalancing after reassessing holdings and replacing laggards with stronger assets protects long term compounding.

🔵 Anchoring bias, or fixating on previous price levels, often hinders rational investment choices.

Diversification & Risk Management

🔵 Effective diversification across different asset types (e.g., stocks, bonds, gold) provides resilience against market volatility.

🔵 Incorporating non correlated hedges (for example, gold or other alternative investments) helps safeguard the overall portfolio from downturns.

🔵 Keeping some allocations in assets that counterbalance equity market risks aids in managing drawdowns and preserving purchasing power.

Action Plan for Wealth

🔵 Build wealth through discipline, not prediction; trust in a process that emphasizes regular evaluation and unemotional decision-making.

🔵 Diversify portfolios for both growth and protection from unforeseen events, ensuring no single asset class dominates.

🔵 Accept occasional losses; cut underperformers promptly, and let winners run according to your established system.

🔵 Set and review financial plans on a specific schedule, making adjustments as needed but always consistent with the chosen methodology.

Personal wealth grows by practicing systematic investing, regular portfolio checks, diversification, and embracing a rule-based mindset for all financial actions.

Team: Creditmoneyfinance.com